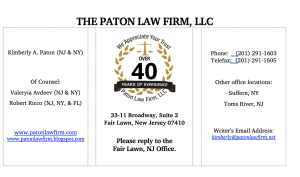

THE PATON LAW FIRM, LLC

MEMORANDUM

From: Kimberly Paton.

To: Wyckoff Magazine Article

Date: September 17, 2024

“Estate Planning—What is it and why do I care?”

Estate Planning is the “effective, economical and efficient way to protect yourself, your family and your assets during your lifetime ; and to transfer your assets to your beneficiaries at your death”.

There are a number of techniques that we, as Estate Planning Attorneys, use to accomplish this. I call Estate Planning a “layer cake” because we add (or layer on) techniques as appropriate. Not everyone needs all of the techniques. To overdo an Estate Plan breaks one of the important rules of being economical.

Therefore, I start every Estate Plan with the Basic Layer. Everyone does need a:

- WILL—to distribute your assets at your death; name an Executor to make sure that your instructions are carried out.We can add a Trust inside the Will (called a “Testamentary Trust”) to protect minor or vulnerable beneficiaries, save potential Estate Taxes, add asset protection, including protection from Medicaid; and/or add a Guardian for minor or incapacitated family members.

- FINANCIAL POWER OF ATTORNEY (POA) to authorize someone you trust to handle your assets, presumably when you cannot; but generally, the POAs are valid as soon as you sign them, so choose your Agent carefully and change your Agent if you have any concerns later.These concerns don’t need to be that the Agent will steal assets. The concerns could be that the Agent has a different philosophy about handling assets, or they have become vulnerable or they have moved a distance away.

- HEALTH CARE PROXY (AKA Medical Power of Attorney)—to authorize a trusted person to handle medical decisions that restore or maintain your health in the event that you cannot. Again, chose your agent carefully and change as appropriate.

You should always name an Agent or Executor for each document and then at least one contingent Agent or Executor so that you have a contingency plan already in place.

The Next Layer(s) could be:

- A Living Revocable Trust—which merely avoids probate. There is no protection of the Trust assets. In New Jersey Probate is very straightforward so you may not want this; but if you own property in other states then a Revocable Trust is recommended to avoid delay.

- A Living Irrevocable Trust—which helps protect assets from Creditors and allows you to qualify for benefits, including VA benefits and Medicaid benefits. However, you are giving away your assets so you must understand all of the consequences of doing so. There are pros and cons that you must understand and then you can make your decisions.

- A Special Needs Trust or a Supplemental Needs Trust to allow a disabled family member to enjoy assets and a better quality of life, without being disqualified from governmental benefits (like Medicaid). This Trust can be used (carefully) for the person receiving these governmental benefits.This is an especially complicated Trust so we must review the provisions carefully.

- An Irrevocable Life Insurance Trust (“ILIT”)—this Trust is the owner and beneficiary of a life insurance policy and it protects the life insurance proceeds from Estate Taxes, creditors, and/or Medicaid/VA Benefits when properly drafted. Currently, most people do not have to worry about Estate Taxes because New Jersey eliminated the Estate Tax in 2018; and the Federal Estate Tax Exemption is currently very high (over $13 million per person). This can change.

- Trusts can also be used to protect children from a prior marriage(s) or relationships and your current spouse.

As I said, not everyone needs all of the techniques, but you must understand and prioritize your own goals and the consequences of each technique to make an informed decision. I call this a “fruit salad” because we must analyze all consequences under different aspects of the laws. We, at the Paton Law Firm, have over 40 years of experience in helping families understand the techniques and consequences so that they can decide what is best for them and their families; and then we implement the Estate Plan.